Hayward Tyler (AIM:HAYT) beware debt fuelled expansion and enthusiasm for awards…and royal visits!

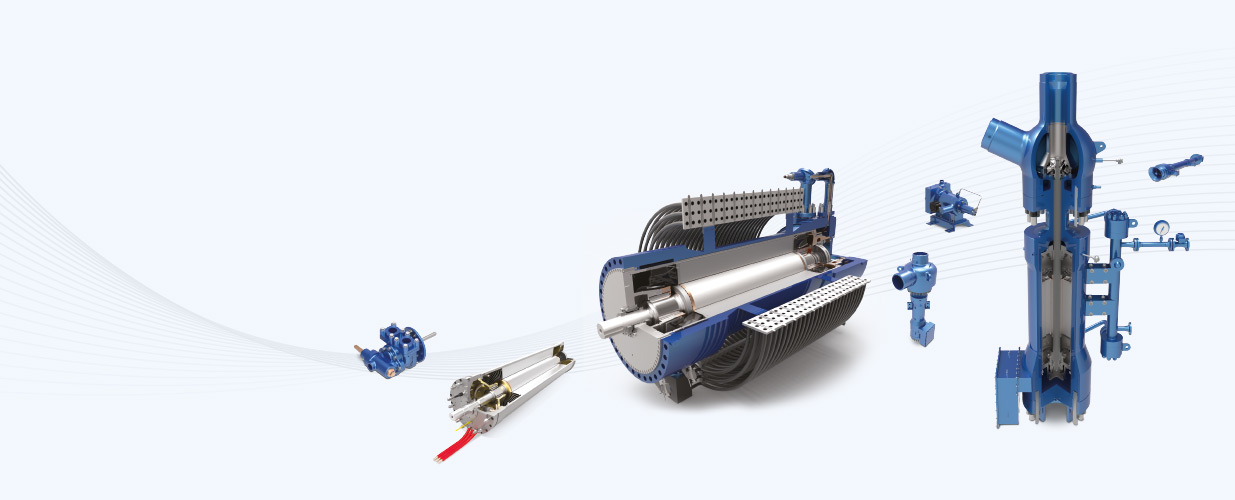

With the oil price reasonably stable, currency supportive (approx 80% of revenue overseas), turnover meaningful (£62m last financial year) and a huge installed base of products there should be plenty to like about specialist engineering group Hayward Tyler Group in the curent environment. We appreciate it’s always going to be a business where large orders can influence single financial years but the regular trickle of after market business, which represents more than 50% of overall…

Previous article Next article