Having experienced a dramatic rise and fall over the past decade, Mulberry faces an uncertain future. However, its brand value and growth opportunities are not fully reflected in the current valuation and its approach to sustainability is impressive. Strong growth in the Group's Asian markets as well as through digital platforms is also seeing it recover better than previously anticipated. The shares still have a long way to go to return to previous glories, but it is certainly looking encouraging for our Bonkers Bargain.

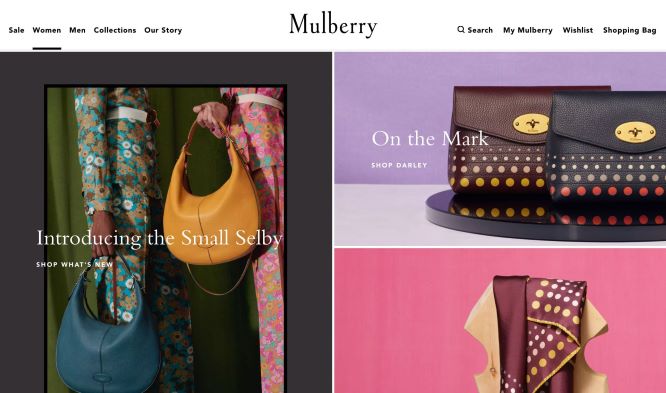

The past decade has been a ‘rollercoaster ride’ for luxury leather goods producer and retailer Mulberry (LON:AIM), previously one of AIM’s largest companies.

Having traded at 2470p per share eight years ago, it now has a share price a fraction of that figure.

While it faces potential threats such as weak trading conditions in a highly competitive marketplace, its brand value and online growth opportunities could provide catalysts for its share price.

Therefore, in our view, the stock has…

Continue reading our content…

Gain access to all our excellent content for just £90 per year, that’s just 25p per day for financial freedom.

- Unlimited access to our market-beating portfolios

- In-depth coverage of many of the world’s great companies

- Unique insights from our top research team

Register FREE for access to limited content.

- Company and markets insights

- Sponsored content

- Podcasts

Previous article

Next article

More on Frasers Group

06/12/2024 · Company Insights

News covered here incudes our assessment of results from a lowly valued UK fund manager, whose…

01/10/2024 · Company Insights

One of AIM’s largest companies seems inclined to accept a private equity funded offer, with an…

More on Hermes International SCA

27/04/2024 · Podcasts

In this episode of the Investor’s Champion Podcast, Chris and Lee discusss yet more impressive results…

28/06/2023 · Company Insights

Having experienced a dramatic rise and fall over the past decade, Mulberry faces an uncertain future.…

More on LVMH Moet Hennessy Louis Vuitton

03/02/2025 · Portfolio

US reporting season is upon us with many of our Ultimate Stocks caught up in the…

29/12/2024 · Podcasts

In this episode of the Investor’s Champion Podcast, hosts Chris and Lee discuss the performance of…

More on Mulberry Group plc

01/10/2024 · Company Insights

One of AIM’s largest companies seems inclined to accept a private equity funded offer, with an…

28/06/2023 · Company Insights

Having experienced a dramatic rise and fall over the past decade, Mulberry faces an uncertain future.…

More Company Insights

This innovative legal firm continues to deliver

Plenty of recovery appeal here and some big dividends

Star performer is trading ahead again

More on Frasers Group

More on Hermes International SCA

More on LVMH Moet Hennessy Louis Vuitton

More on Mulberry Group plc

More Company Insights