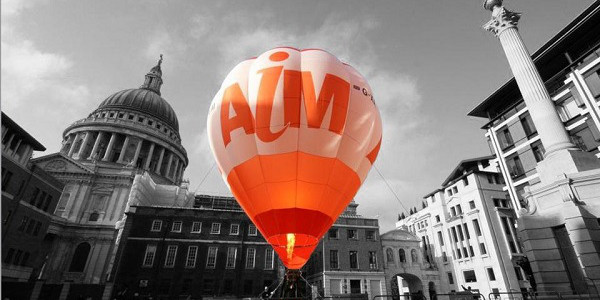

AIM: chasing the same stocks

The diminishing size of AIM and its inability to attract exciting IPOs is a problem which we think is counterbalanced by the market’s rising quality. But there are deeper problems lurking which we address in this review of 2019.

At the end of 2019 there were 863 companies on AIM with the total market value of £104bn. This compares to 923 companies at the end of 2018 when AIM’s total market value stood at £91.2m.

While £100bn sounds like quite a large number, it’s worth remembering that the realistic free float (the number of shares freely traded) is actually much smaller, with a large element of AIM’s shareholder base made up founders, their families and…

Previous article Next article