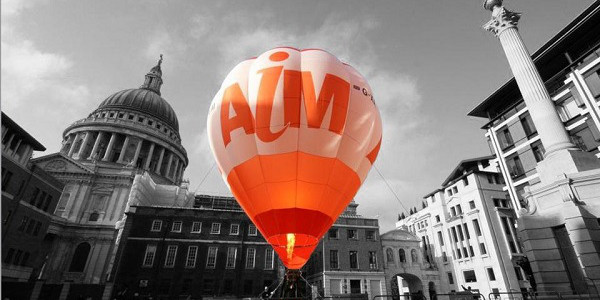

Not just IHT money driving AIM higher – blame the big institutions!

A closer look at the top end of AIM reveals that the larger AIM stocks are dominated by institutional investors and not by private client managers or AIM for Inheritance Tax (‘IHT’) portfolio specialists.

At the end of February 2017 the top 50 companies on AIM by market capitalisation had an aggregate value of £37.7bn, representing 43% of AIM’s overall market capitalisation. In turn, the top 10 companies dominated this sub set with an aggregate…

Previous article Next article